W Trading Pattern

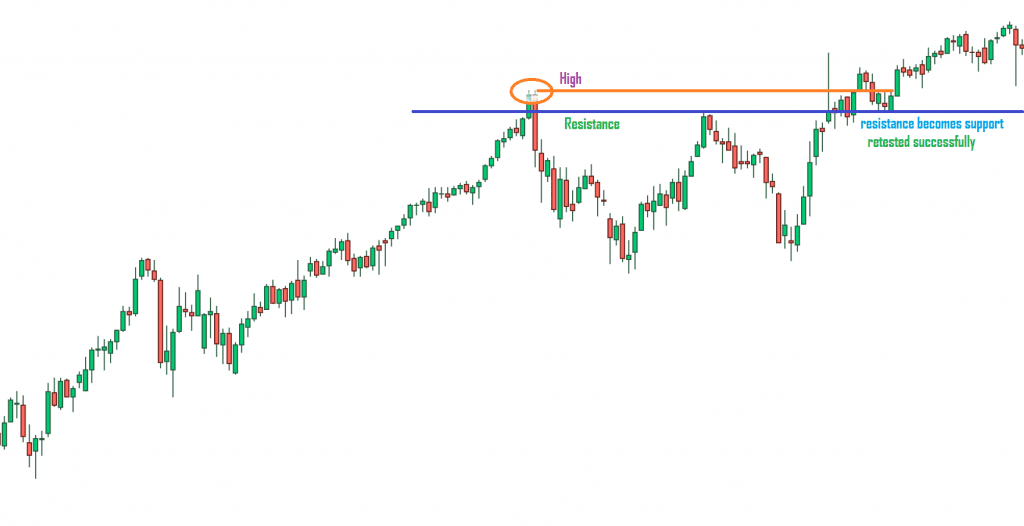

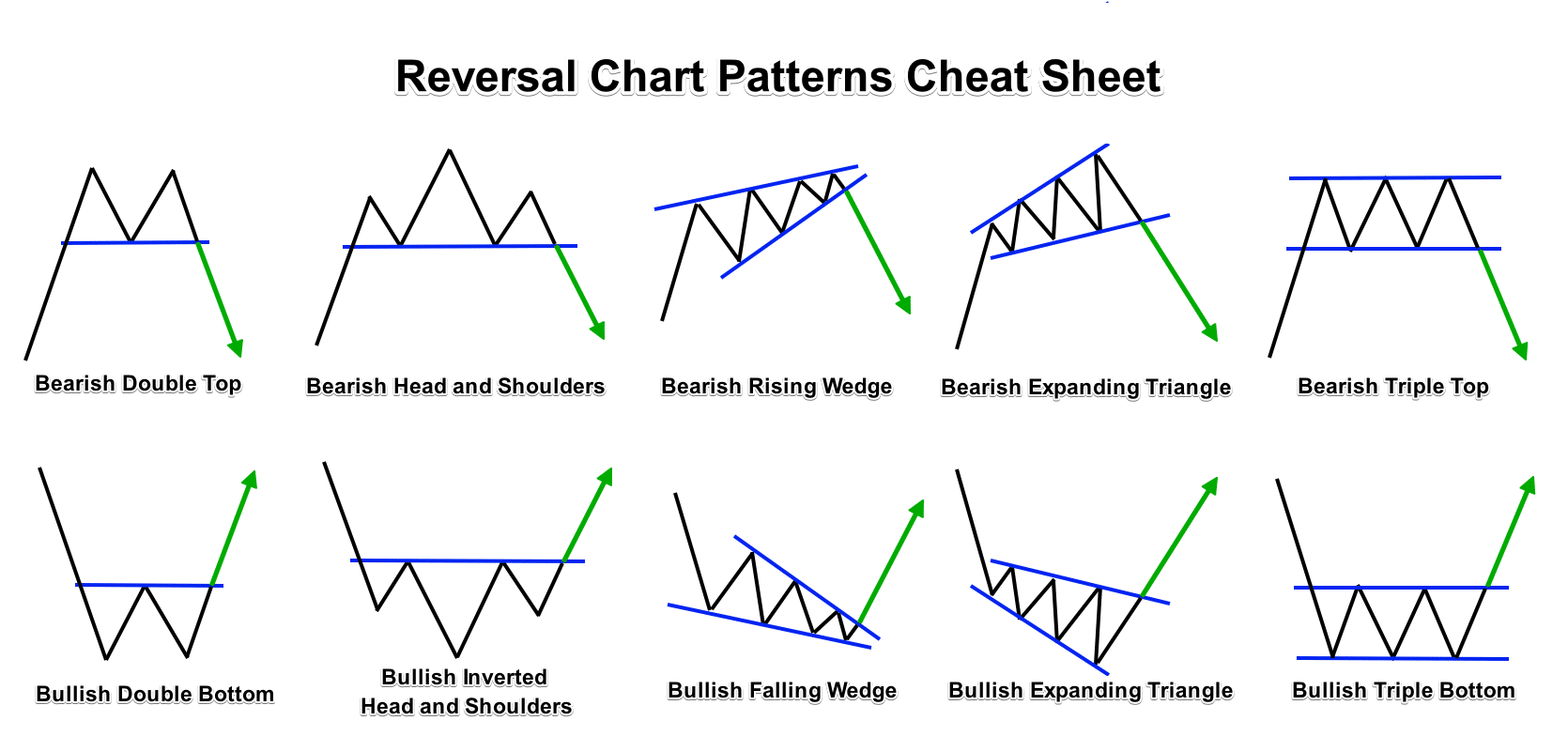

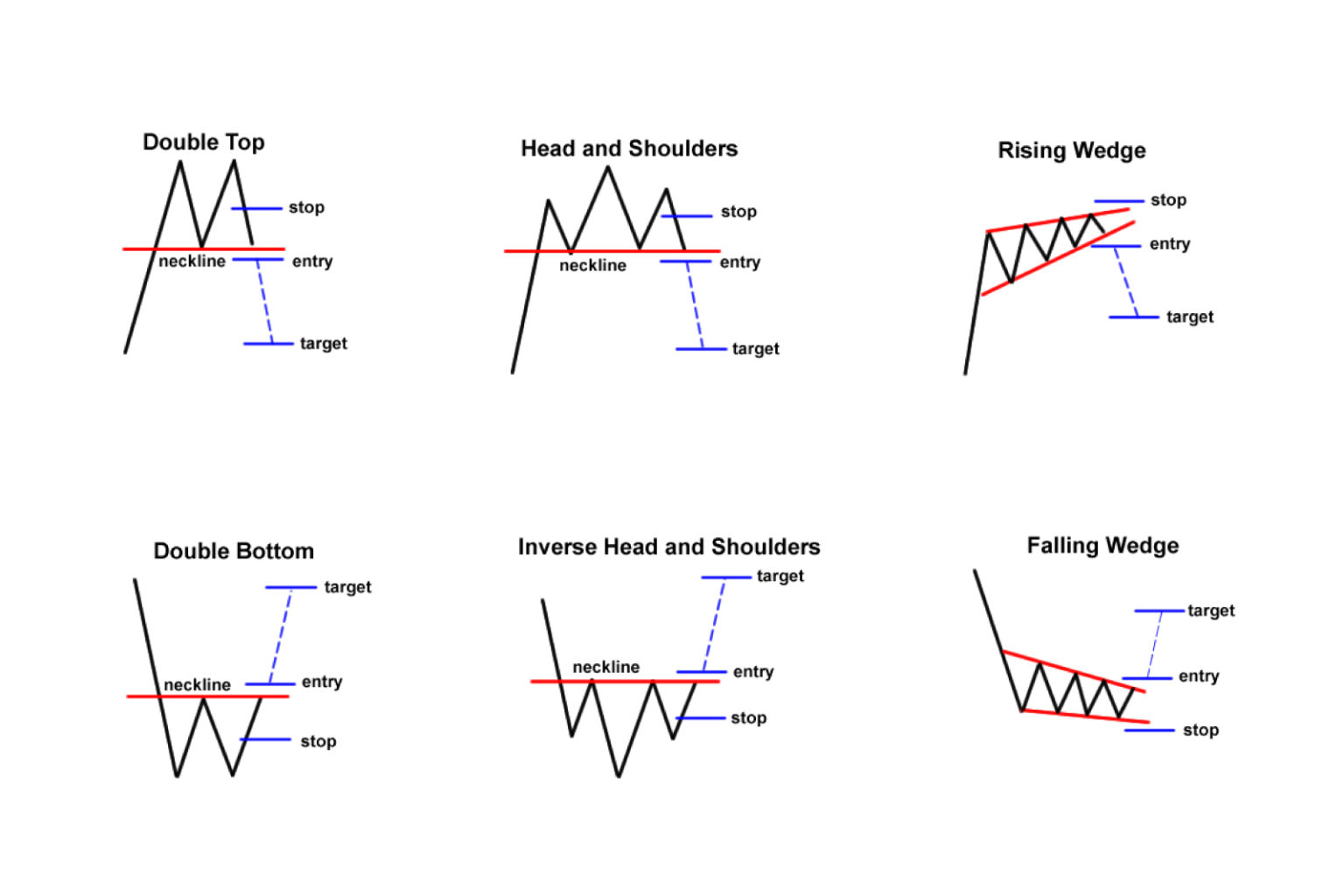

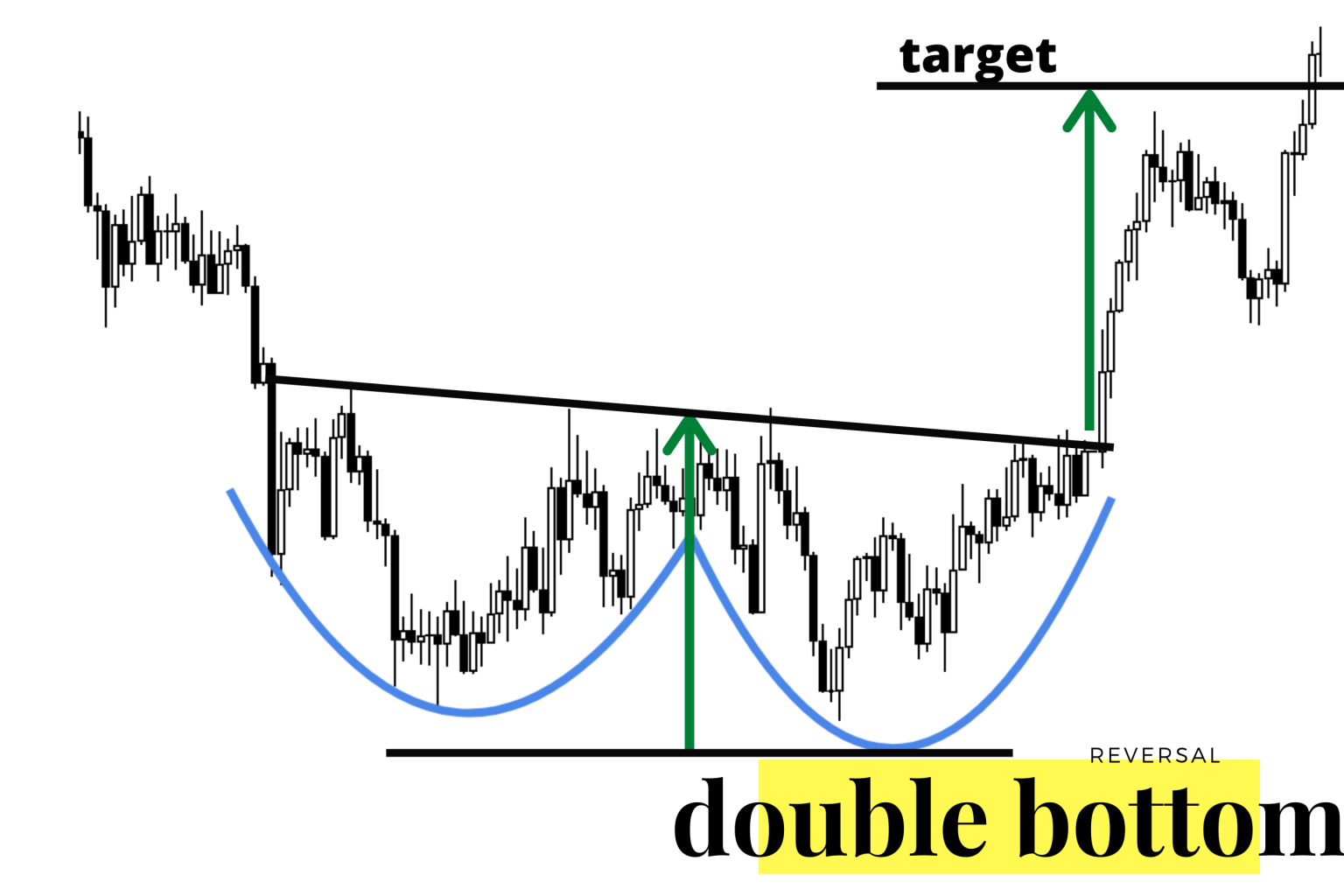

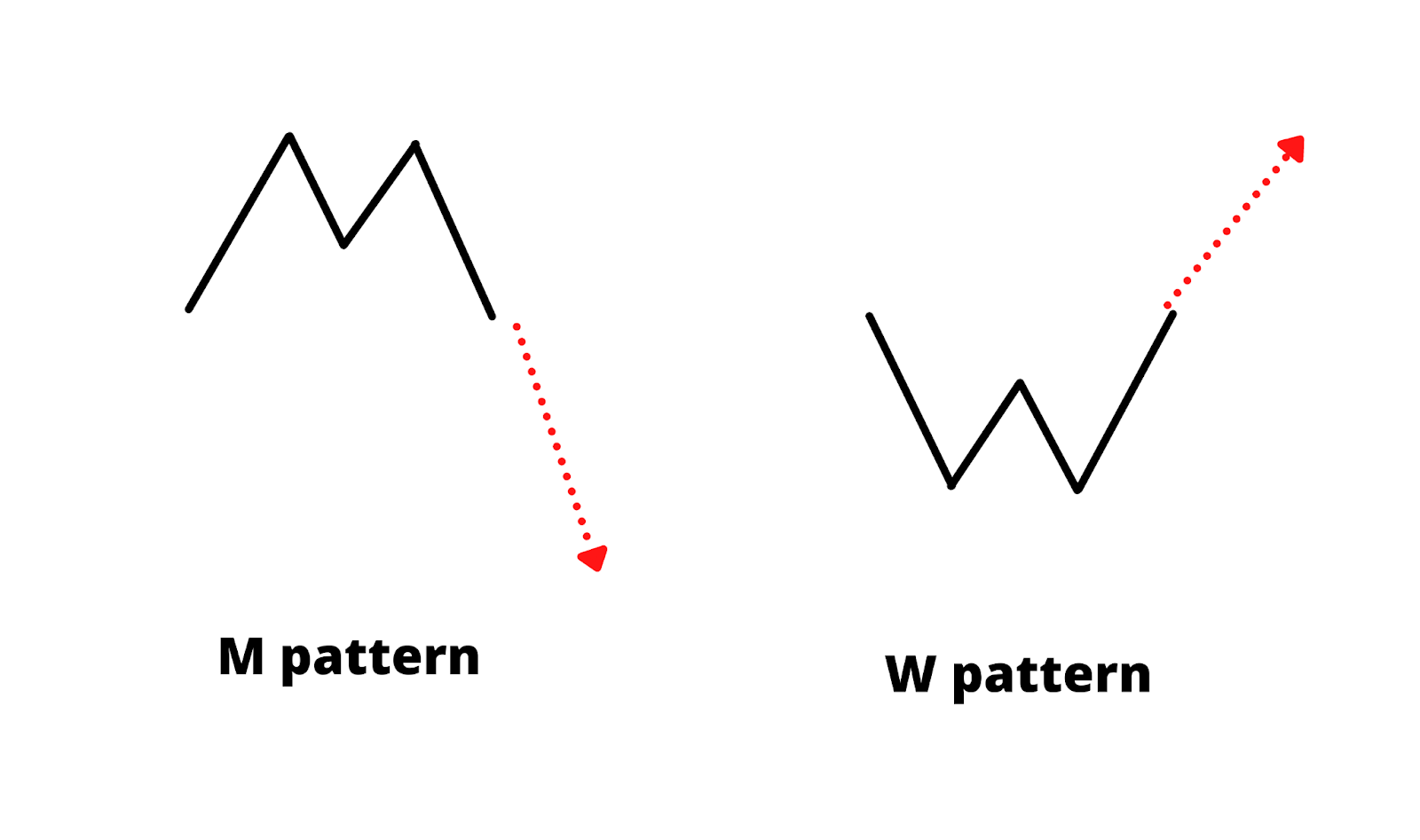

W Trading Pattern - This first trend reversal is usually short in duration and does not last long and the price falls again. How do you trade the w pattern? Web understanding the fundamentals of w pattern chart in the stock market. The pattern starts emerging when the prices first jump off after the constant horizontal trend line of an asset. The w pattern is a technical analysis pattern that is formed on the price chart. Web for a “w” pattern to be qualified for trading, look for the following characteristics. Traders look for a significant increase in trading volume during the formation of the second low, indicating increased buying pressure and a potential reversal. The double bottom pattern always follows a major or minor downtrend in a particular. The renko charts must be in an uptrend. If it is moving from bottom left to. The w pattern is a technical analysis pattern that is formed on the price chart. Web double top and bottom patterns trading (w pattern trading) are technical analyses applicable in predicting reoccurring patterns. In this article, we will explore what the w pattern is, how to identify it, and some tips and tricks for successfully trading it. The script also calculates the percentage difference between the current low and the previous high, displaying this value on the chart when the pattern is detected. The w chart pattern is a reversal pattern that is bullish as a downtrend holds support after the second test and rallies back higher. Web the w trading pattern is a reversal pattern used to identify changes in market trends. Traders look for a significant increase in trading volume during the formation of the second low, indicating increased buying pressure and a potential reversal. Web one popular pattern that traders often look out for is the double bottom, also known as the w pattern. Web the classic w pattern is the most basic form of the double bottom pattern. To spot the w pattern, traders should first identify a strong downtrend in the forex market. Web understanding the fundamentals of w pattern chart in the stock market. The world of trading is filled with patterns and signals that traders use to make informed decisions. Web one popular pattern that traders often look out for is the double bottom, also known as the w pattern. Traders may use w bottoms and tops chart patterns as powerful. Web the w pattern, a technical trading indicator, signals a bullish market reversal. How do you trade the w pattern? In this article, we will explore what the w pattern is, how to identify it, and some tips and tricks for successfully trading it. The pattern starts emerging when the prices first jump off after the constant horizontal trend line. Web the w pattern is a technical analysis pattern that resembles the letter “w” and is formed by two consecutive troughs followed by a higher peak. The double bottom pattern occurs when the price of a currency pair reaches a low point, bounces back up, dips again to the same level,. The w chart pattern is a reversal pattern that. Traders may use w bottoms and tops chart patterns as powerful indicators for buying and selling decisions. The pattern is characterized by two distinct troughs or peaks that mark. The double bottom pattern occurs when the price of a currency pair reaches a low point, bounces back up, dips again to the same level,. What is the w pattern? Web. Web the w chart pattern is read as a bullish turnaround where prices are expected to increase after weeks or months of price decline. Web the w pattern in trading is a formation on price charts that signifies a potential bullish reversal after a downward trend. Web the w pattern, a technical trading indicator, signals a bullish market reversal. A. This pattern is highly regarded in the trading community and is used to pinpoint potential buy signals. If it is moving from bottom left to. What is the w pattern? It's characterized by two troughs at roughly the same low level, separated by a peak. How to spot a double bottom pattern in a w pattern chart. Web w pattern trading is a technical trading strategy using stock market indicators to help locate entry and exit points. Frequently surfacing on charts as a bullish reversal pattern, adept traders survey this figure to pinpoint the emergence of upward potential. Web the classic w pattern is the most basic form of the double bottom pattern. Web the w pattern,. Traders may use w bottoms and tops chart patterns as powerful indicators for buying and selling decisions. The renko charts must be in an uptrend. Web w pattern trading is a technical trading strategy using stock market indicators to help locate entry and exit points. Web double top and bottom patterns are chart patterns that occur when the underlying investment. Importance of w pattern chart in trading strategies. Web these patterns, aptly named the w pattern and m stock pattern, are classic chart formations that technical traders watch for. This pattern signifies a reversal of a downtrend and often indicates a bullish trend reversal. It's characterized by two troughs at roughly the same low level, separated by a peak. If. This pattern signifies a reversal of a downtrend and often indicates a bullish trend reversal. Web one popular pattern that traders often look out for is the double bottom, also known as the w pattern. This pattern is highly regarded in the trading community and is used to pinpoint potential buy signals. Web the w pattern is typically found in. This pattern is highly regarded in the trading community and is used to pinpoint potential buy signals. Web these patterns, aptly named the w pattern and m stock pattern, are classic chart formations that technical traders watch for. This pattern signifies a reversal of a downtrend and often indicates a bullish trend reversal. One such pattern that has gained prominence is the w pattern. The double bottom pattern occurs when the price of a currency pair reaches a low point, bounces back up, dips again to the same level,. The w pattern is a technical analysis pattern that is formed on the price chart. The pattern is characterized by two distinct troughs or peaks that mark. Frequently surfacing on charts as a bullish reversal pattern, adept traders survey this figure to pinpoint the emergence of upward potential. The script also calculates the percentage difference between the current low and the previous high, displaying this value on the chart when the pattern is detected. The renko charts must be in an uptrend. It consists of two equal lows, creating a symmetrical pattern. Web one popular pattern that traders often look out for is the double bottom, also known as the w pattern. Web big w is a double bottom chart pattern with talls sides. Web double top and bottom patterns are chart patterns that occur when the underlying investment moves in a similar pattern to the letter w (double bottom) or m (double top). The difference between w pattern and other chart patterns. A favorite of swing traders, the w pattern can be formed over a.W Pattern Double Bottom Is a Reliable Bullish Trading Signal

W Trading Pattern A Comprehensive Guide BrokerExtra

How to Trade Triangle Chart Patterns FX Access

W Pattern Trading YouTube

W Pattern Trading The Forex Geek

Pattern Trading Unveiled Exploring M and W Pattern Trading

How Important are Chart Patterns in Forex? Forex Academy

Know the 3 Main Groups of Chart Patterns FX Access

W Pattern Trading New Trader U

W Pattern Trading vs. M Pattern Strategy Choose One or Use Both? • FX

The W Chart Pattern Is A Reversal Pattern That Is Bullish As A Downtrend Holds Support After The Second Test And Rallies Back Higher.

This First Trend Reversal Is Usually Short In Duration And Does Not Last Long And The Price Falls Again.

Web The W Pattern In Trading Is A Formation On Price Charts That Signifies A Potential Bullish Reversal After A Downward Trend.

In This Article, We Will Enter Into The W Pattern In Trading, Exploring Its Formation, Significance, And How Traders Can Leverage It To Enhance Their Trading.

Related Post: