Spinning Top Candlestick Pattern

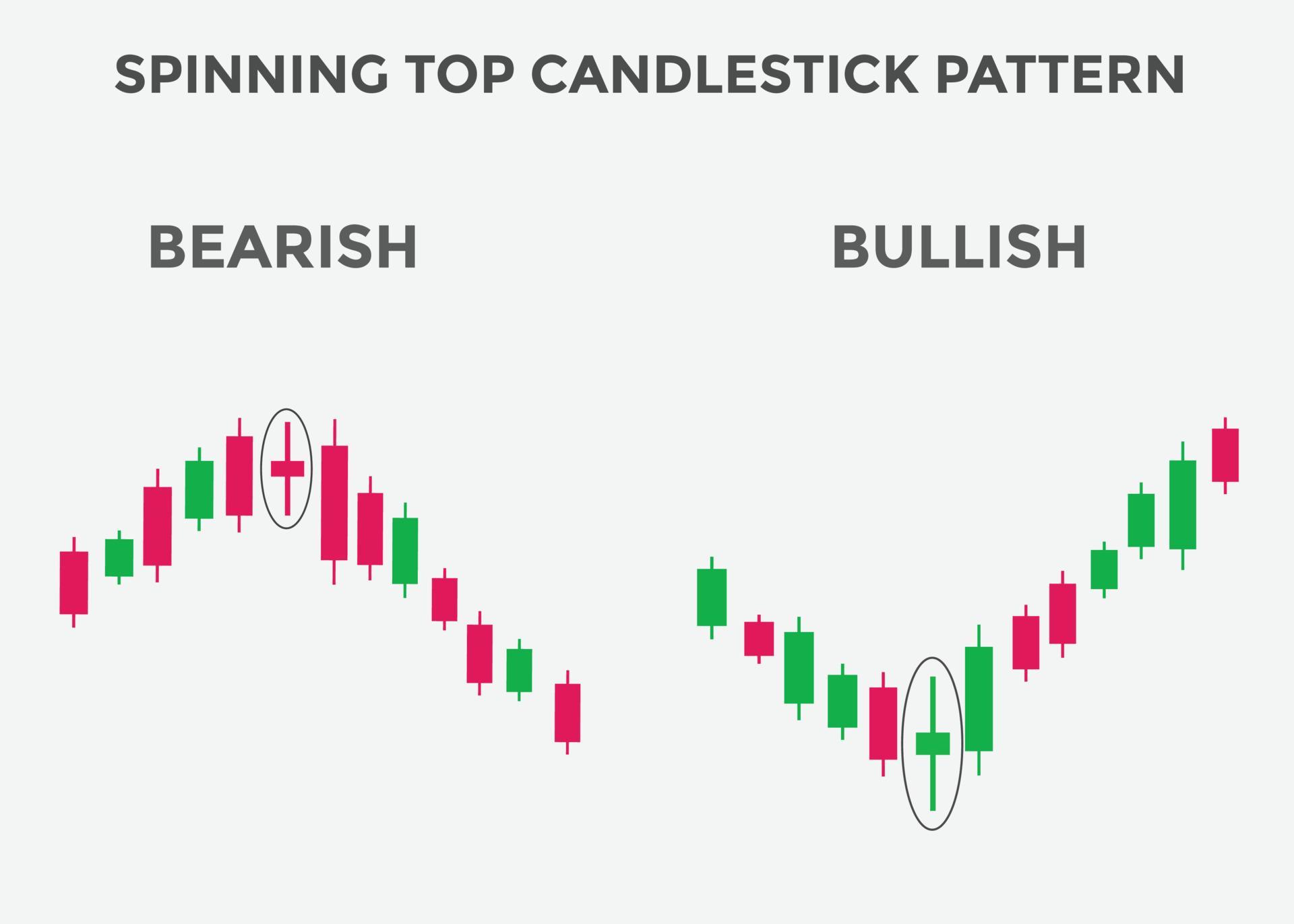

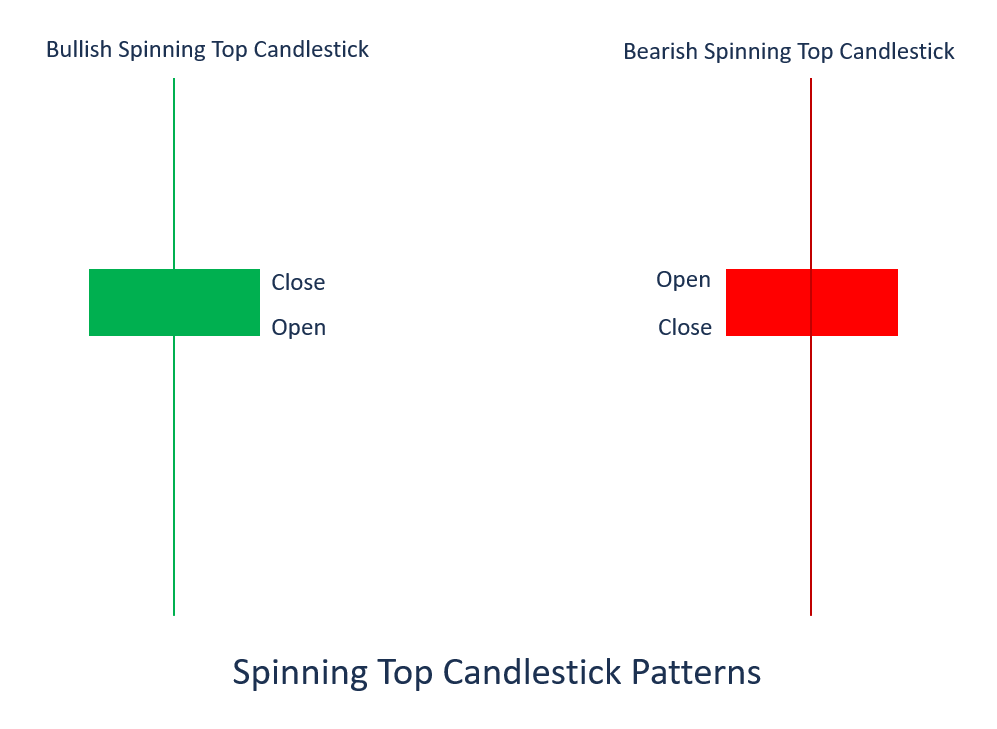

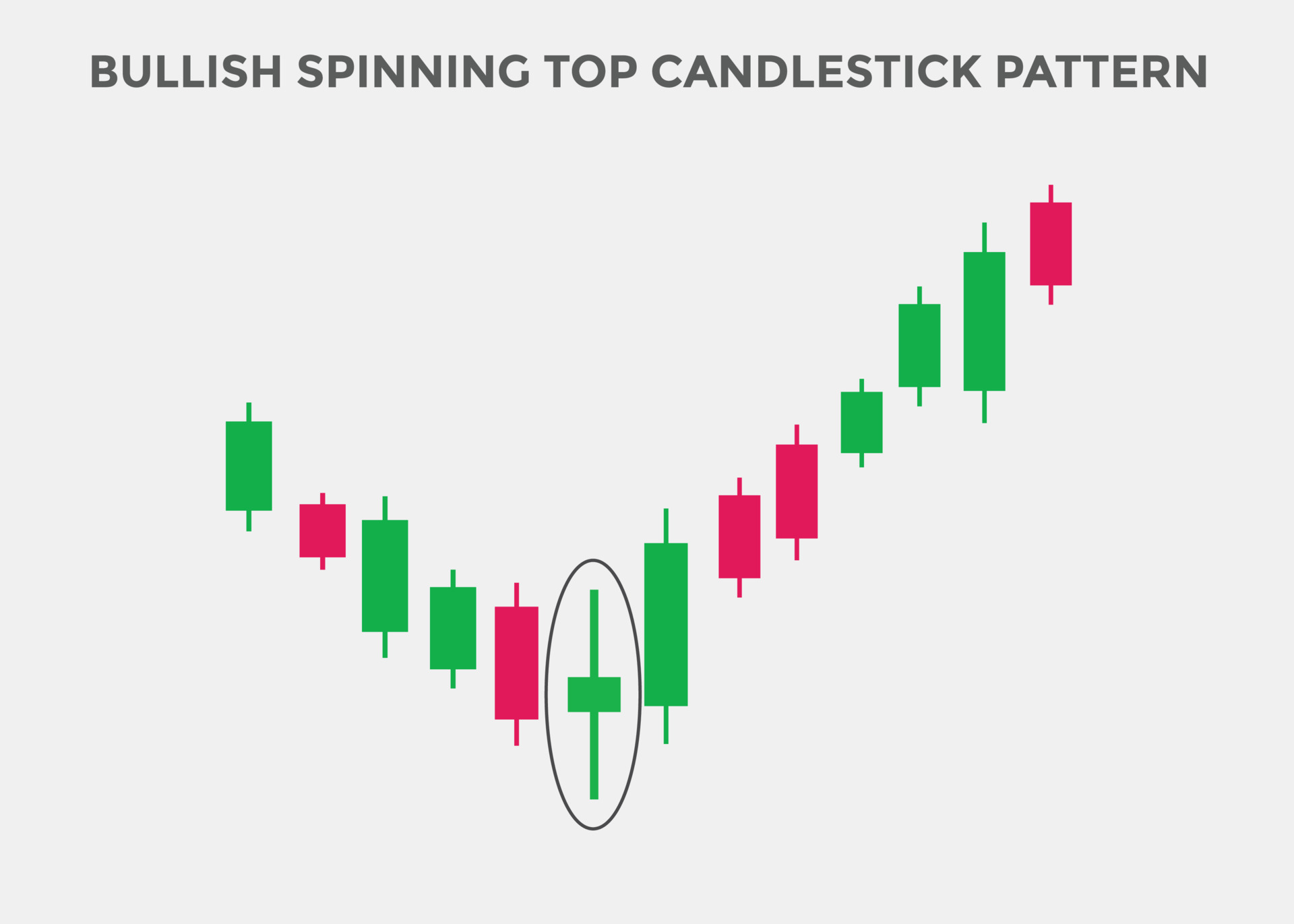

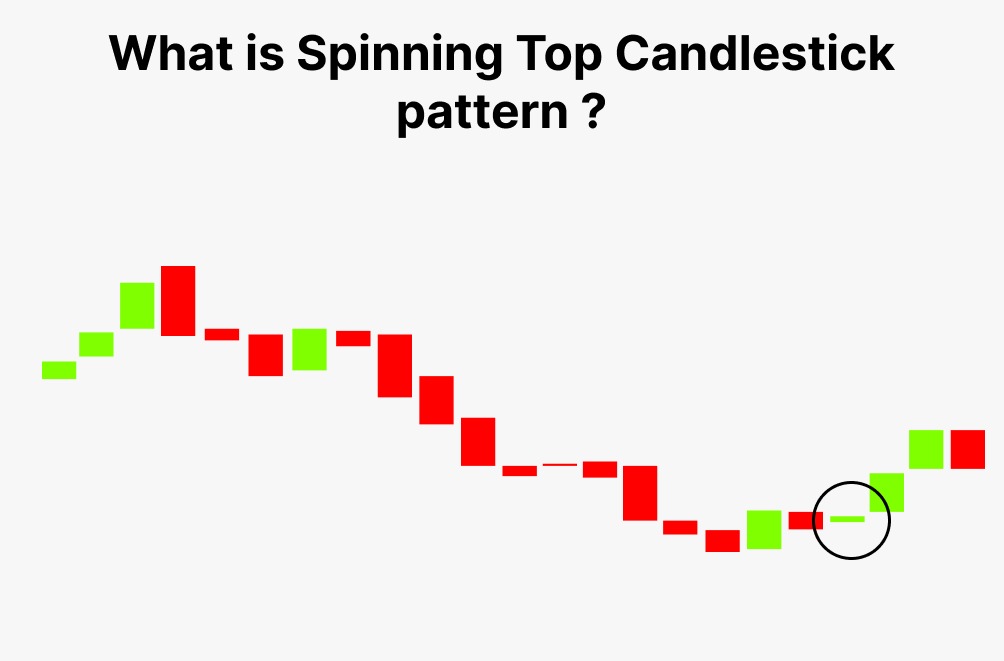

Spinning Top Candlestick Pattern - This pattern signals a standoff between buyers and sellers, suggesting market indecision. Web answer 1 of 7: Ddp is free so we opt for the standard plan. Spinning tops form when the bulls and bears battle for control of price, but neither side can overwhelm the other. Web the spinning top candlestick is a fascinating puzzle for traders seeking crucial market insights! It is another common and effective candlestick reversal pattern used by traders to. They emerge when bullish and bearish forces, speculating on price rise and decline, respectively, are evenly matched, resulting in a minimal net price change. The real body is small as it shows little difference between the open and close prices. Web known as spinning top candlesticks, they signal indecision in the market. Web a spinning top candlestick is a type of candlestick pattern characterized by a small body situated between long upper and lower wicks. A small real body means that the open price and close price are close to each other. Of course we will still have to pay tips and any extra food (it seems like we would be missing one meal on this plan???) 3. A spinning top candle shows market uncertainty, no clear buyer/seller control, implying a. Web precision, durability and elegance is what sets foreverspin™ apart from other spinning tops. Web what is spinning top candlestick? This configuration suggests a session where neither bulls nor bears could gain the upper hand, ending nearly where they began. Web answer 1 of 7: Web defining the spinning top candlestick pattern. Spinning top candlestick is a pattern with a short body between an upper and a lower long wick. Web spinning top candlestick patterns are indicative of market uncertainty regarding future price movements. Web a spinning top is a candlestick formation that signals indecision regarding the future trend direction. Web answer 21 of 33: Web the spinning top candlestick pattern is a single candlestick pattern that is similar in appearance to the evening star and the morning star patterns, except that it consists of a single candlestick and need not gap away from. Of course we will still have to pay tips and any extra food (it seems like we would be missing one meal on this plan???) 3. The candlestick itself is defined by a short body surrounded by long wicks (approximately the. Ddp is free so we opt for the standard plan. Ddp is not free next december, so we skip. They emerge when bullish and bearish forces, speculating on price rise and decline, respectively, are evenly matched, resulting in a minimal net price change. Web answer 21 of 33: Web a spinning top is a single candlestick pattern which represents indecision about the future price movement. Spinning tops form when the bulls and bears battle for control of price, but. It is another common and effective candlestick reversal pattern used by traders to. Its ability to identify market indecision and pauses in price movements makes it a truly invaluable tool in your trading arsenal. Web answer 21 of 33: Web what is spinning top candlestick? Of course we will still have to pay tips and any extra food (it seems. It is another common and effective candlestick reversal pattern used by traders to. Web spinning top candlesticks can form a the the top or bottom of a pattern, signaling the end of a trend. A small real body means that the open price and close price are close to each other. Web a spinning top is a candlestick formation that. The bears, of course, don’t like this. Web a spinning top candlestick is a type of candlestick pattern characterized by a small body situated between long upper and lower wicks. Web the spinning top is a candlestick pattern that signals indecision between buyers and sellers and may indicate a possible trend reversal. Web answer 1 of 7: If a spinning. It has a small body closing in the middle of the candle’s range, with long wicks on both sides. The spinning top is distinguished by its minimal real body, positioned centrally between comparably long shadows. First, the bulls push price beyond the open, causing the candle to turn bullish. Web a spinning top is a candlestick formation that signals indecision. Web answer 1 of 7: Web the spinning top candlestick is a fascinating puzzle for traders seeking crucial market insights! Web spinning top candlestick patterns are indicative of market uncertainty regarding future price movements. Web what is a spinning top in candlestick patterns? Similar to a doji pattern, a spinning top is considered a neutral pattern, although many do end. Web a spinning top candlestick pattern have a small real body with upper and lower shadows of the almost same length. Web the spinning top is a candlestick pattern that signals indecision between buyers and sellers and may indicate a possible trend reversal. The spinning top illustrates a scenario where neither the seller nor the buyer has gained. Web the. A spinning top that is built to last forever. Web a spinning top candlestick is a type of candlestick pattern characterized by a small body situated between long upper and lower wicks. Web a spinning top candlestick pattern have a small real body with upper and lower shadows of the almost same length. Web what is spinning top candlestick? Web. Web a white spinning top is a bullish candlestick chart pattern that indicates that the closing price of a security or other financial instrument was higher than the closing price. The pattern shows indecision as buyers and sellers both pushed the price on either sides. Spinning tops form when the bulls and bears battle for control of price, but neither side can overwhelm the other. Web a spinning top is a candlestick formation that signals indecision regarding the future trend direction. The candlestick itself is defined by a short body surrounded by long wicks (approximately the. Web known as spinning top candlesticks, they signal indecision in the market. It has a small body closing in the middle of the candle’s range, with long wicks on both sides. This candlestick pattern has a short real body with long upper and lower shadows of almost equal lengths. Of course we will still have to pay tips and any extra food (it seems like we would be missing one meal on this plan???) 3. The spinning top illustrates a scenario where neither the seller nor the buyer has gained. Web a spinning top is a single candlestick pattern which represents indecision about the future price movement. A small real body means that the open price and close price are close to each other. Our girls will be 4 (turning 5) and 2 1/2. Web spinning top candlestick patterns are indicative of market uncertainty regarding future price movements. Web a spinning top candlestick is a chart pattern that forms over a single session. If a spinning top candlestick forms at the end of a head and shoulders pattern, look out for a bearish reversal coming.Understanding & Trading the Spinning Top Candlestick Pattern

Spinning Top Candlestick Pattern How To use Spinning Top candlestick

Spinning Top Candlestick How to trade with Spinning?

Spinning top candlestick pattern. Spinning top Bullish candlestick

Spinning Top Candlestick Pattern Overview, Formation, How To Trade

Spinning Top Candlestick Pattern Forex Trading

Bullish Spinning top candlestick pattern. Spinning top Bullish

Spinning Top Candlestick Pattern How to trade & Examples Finschool

Spinning Top Candlestick Definition

Bullish Spinning Top Candlestick Pattern Candle Stick Trading Pattern

Web What Is A Spinning Top In Candlestick Patterns?

Web The Spinning Top Is A Candlestick Pattern That Signals Indecision Between Buyers And Sellers And May Indicate A Possible Trend Reversal.

Web Read About The Spinning Top Candlestick Chart Pattern, Including What Causes It To Form And How To Identify It.

Web A Spinning Top Is A Candlestick Pattern With A Short Real Body That's Vertically Centered Between Long Upper And Lower Shadows.

Related Post:

:max_bytes(150000):strip_icc()/dotdash_Final_Spinning_Top_Candlestick_Definition_and_Example_Nov_2020-01-9ebe4d0e8ccb482c92214128a29874de.jpg)