Hammer Candle Pattern

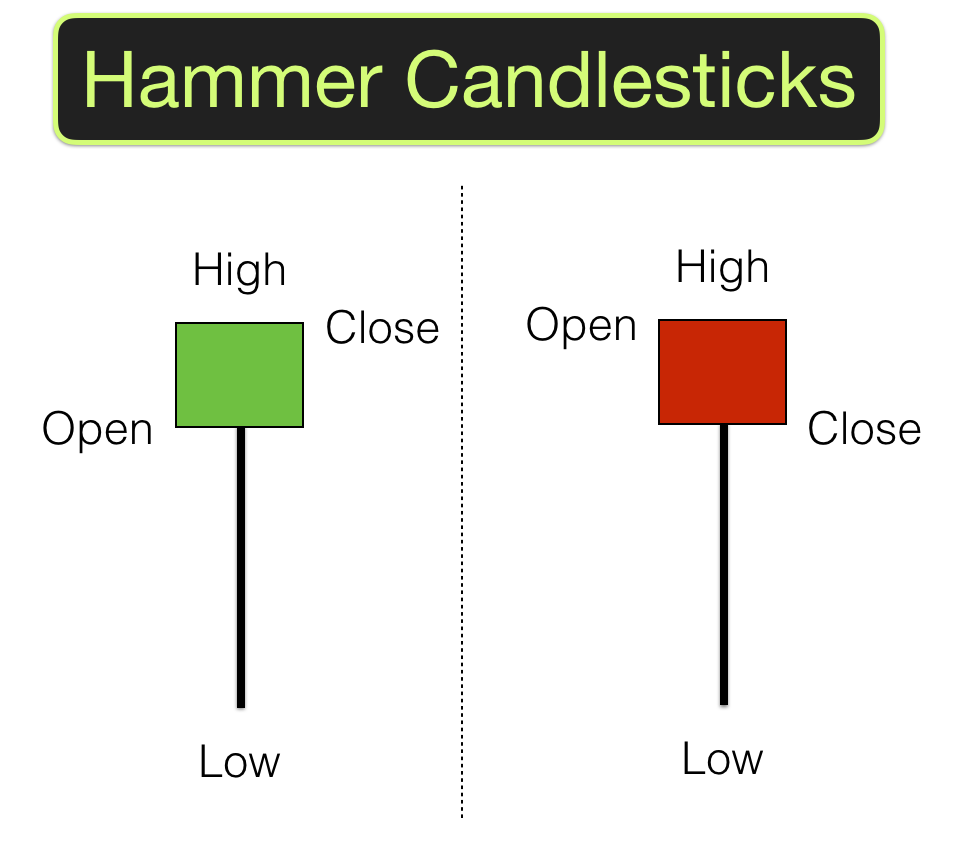

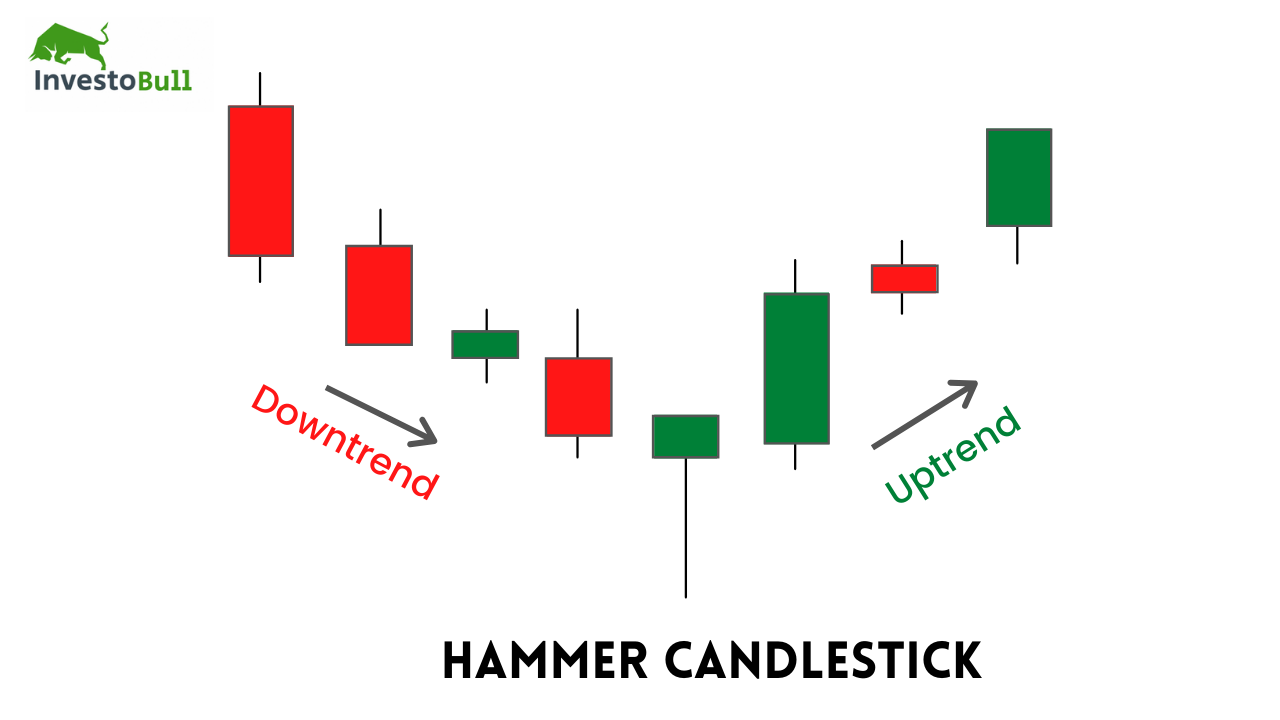

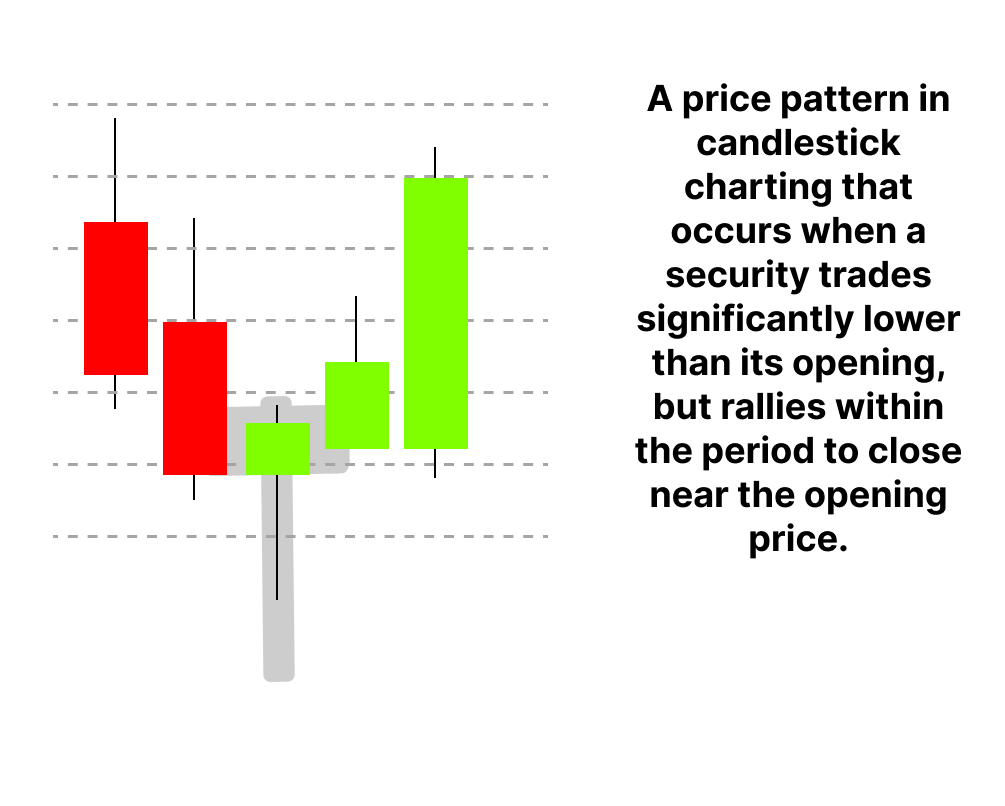

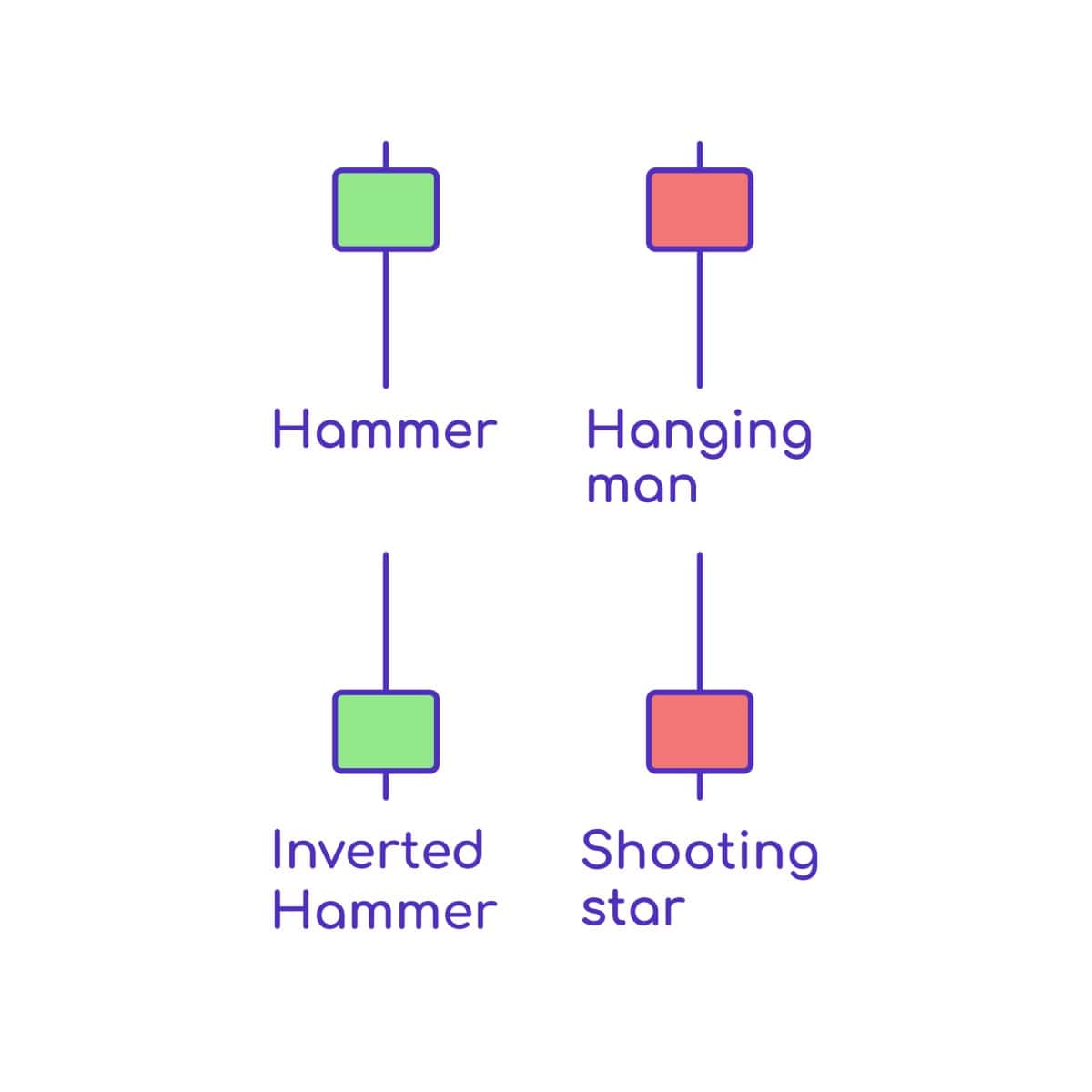

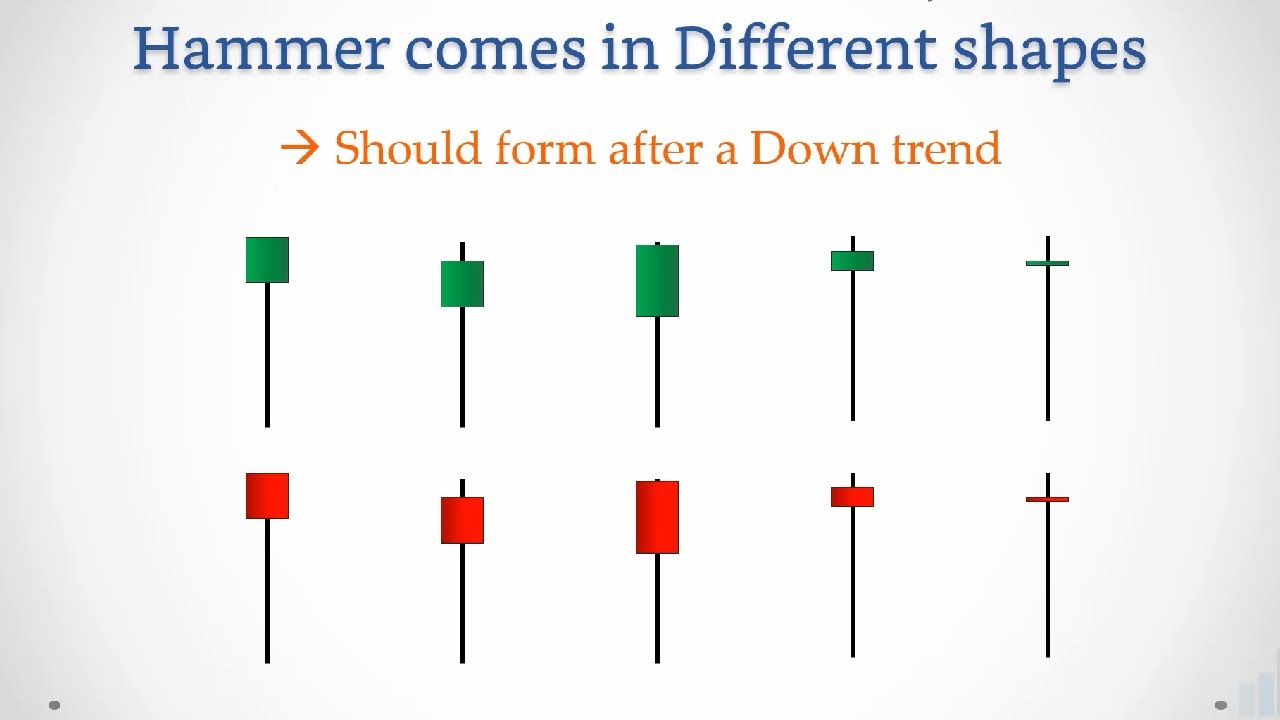

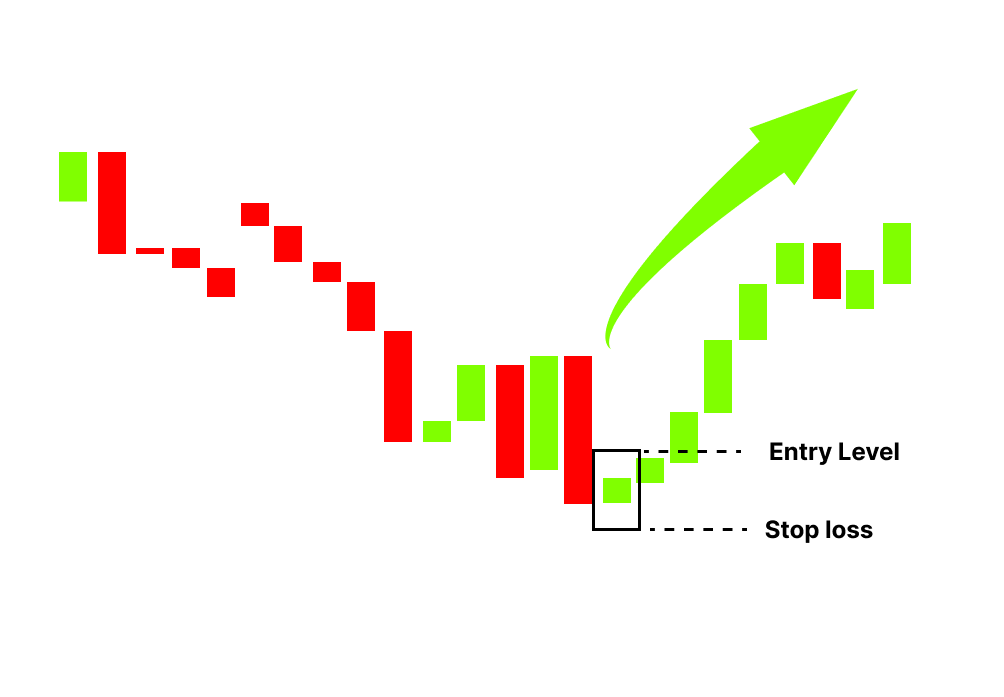

Hammer Candle Pattern - This shows a hammering out of a base and reversal setup. It is often referred to as a bullish pin bar, or bullish rejection candle. The hammer helps traders visualize where support and demand are located. Web the hammer pattern is one of the first candlestick formations that price action traders learn in their career. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. Web jun 11, 202406:55 pdt. Learn what it is, how to identify it, and how to use it for intraday trading. Most price action traders use this candlestick to identify reliable price reversal points. Web the hammer candlestick is one of the most popular candlestick patterns traders use to make sense of a securities’ price action. Web the hammer candlestick pattern is a bullish candlestick that is found at a swing low. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets. The hammer signals that price may be about to make a reversal back higher after a recent swing lower. Web in this blog post, we are going to explore the hammer candlestick pattern, a bullish reversal candlestick. Occurrence after bearish price movement. Web understanding hammer chart and the technique to trade it. It signals that the market is about to change trend direction and advance to new heights. However, a hammer chart pattern was formed in its last trading session, which could mean that the stock found support with bulls being able to counteract the bears. Web a longer body indicates selling pressure or stronger buying. Our guide includes expert trading tips and examples. For investors, it’s a glimpse into market dynamics, suggesting that despite initial selling pressure, buyers are. For investors, it’s a glimpse into market dynamics, suggesting that despite initial selling pressure, buyers are. Web the hammer candlestick is a significant pattern in the realm of technical analysis, vital for predicting potential price reversals in markets. Web the hammer pattern is one of the first candlestick formations that price action traders learn in their career. At its core,. Web hammer heads gift & smoke shop, llc has been set up 7/18/2012 in state fl. Web the hammer pattern is one of the first candlestick formations that price action traders learn in their career. It is often referred to as a bullish pin bar, or bullish rejection candle. The opening price, close, and top are approximately at the same. So, it could witness a trend. The hammer heads gift & smoke shop, llc principal address is 824 e eau gallie blvd, indian harbor beach, fl, 32937. This pattern typically appears when a downward trend in stock prices is coming to an end, indicating a bullish reversal signal. At its core, the hammer pattern is considered a reversal signal that. The hammer helps traders visualize where support and demand are located. The hammer heads gift & smoke shop, llc principal address is 824 e eau gallie blvd, indian harbor beach, fl, 32937. It manifests as a single candlestick pattern appearing at the bottom of a downtrend and. Web the hammer candlestick pattern is a single candle formation that occurs in. A small real body, long lower shadow (twice the length of the body), minimal or no upper shadow, and it forms at the bottom of a downswing. In this post we look at exactly what the hammer candlestick pattern is and how you can use it in your trading. Small candle body with longer lower shadow, resembling a hammer, with. A minor difference between the opening and closing prices forms a small. In short, a hammer consists of a small real body that is found in the upper half of the candle’s range. Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower wick. At. It resembles a candlestick with a small body and a long lower wick. However, a hammer chart pattern was formed in its last trading session, which could mean that the stock found support with bulls being able to counteract the bears. At its core, the hammer pattern is considered a reversal signal that can often pinpoint the end of a. Learn what it is, how to identify it, and how to use it for intraday trading. At its core, the hammer pattern is considered a reversal signal that can often pinpoint the end of a prolonged trend or retracement phase. Web the hammer candlestick is one of the most popular candlestick patterns traders use to make sense of a securities’. It manifests as a single candlestick pattern appearing at the bottom of a downtrend and. In short, a hammer consists of a small real body that is found in the upper half of the candle’s range. Web apr 23, 2023 updated may 3, 2023. Web a hammer candlestick is a term used in technical analysis. Learn what it is, how. In this post we look at exactly what the hammer candlestick pattern is and how you can use it in your trading. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. The opening price, close, and top are approximately at the same price, while there is a long. Examples of use as a trading indicator. The hammer helps traders visualize where support and demand are located. Web the hammer candlestick formation is viewed as a bullish reversal candlestick pattern that mainly occurs at the bottom of downtrends. Web a hammer candlestick is a term used in technical analysis. Web jun 11, 202406:55 pdt. Web a hammer candlestick is a chart formation that signals a potential bullish reversal after a downtrend, identifiable by its small body and long lower wick. After a downtrend, the hammer can signal to traders that the downtrend could be over and that short positions could. For investors, it’s a glimpse into market dynamics, suggesting that despite initial selling pressure, buyers are. It manifests as a single candlestick pattern appearing at the bottom of a downtrend and. Hammer tied for second place and said this experience opened so many doors for her future career in the culinary arts. Mysz have been struggling lately and have lost 11.1% over the past week. Web in this blog post, we are going to explore the hammer candlestick pattern, a bullish reversal candlestick. Web understanding hammer chart and the technique to trade it. This pattern typically appears when a downward trend in stock prices is coming to an end, indicating a bullish reversal signal. Web hammer heads gift & smoke shop, llc has been set up 7/18/2012 in state fl. Web the hammer candlestick pattern is a single candle formation that occurs in the candlestick charting of financial markets.Candlestick Hammer And Shooting Star Bruin Blog

What is Hammer Candlestick Pattern June 2024

Hammer Candlestick Pattern Trading Guide

Hammer Candlestick Pattern Meaning, Examples & Limitations Finschool

The Hammer Candlestick Pattern Identifying Price Reversals

Candlestick Patterns The Definitive Guide (2021)

Hammer Candlestick Pattern Trading Guide

Candle Patterns Picking the "RIGHT" Hammer Pattern YouTube

Hammer Candlestick Pattern Meaning, Examples & Limitations Finschool

Hammer Candlestick Patterns (Types, Strategies & Examples)

They Consist Of Small To Medium Size Lower Shadows, A Real Body, And Little To No Upper Wick.

Web A Hammer Is A Price Pattern In Candlestick Charting That Occurs When A Security Trades Significantly Lower Than Its Opening, But Rallies Within The Period To Close Near The Opening Price.

Web Learn How To Use The Hammer Candlestick Pattern To Spot A Bullish Reversal In The Markets.

A Small Real Body, Long Lower Shadow (Twice The Length Of The Body), Minimal Or No Upper Shadow, And It Forms At The Bottom Of A Downswing.

Related Post: